If you’ve heard about positive expected value (+EV) betting, you probably know that the key to this sports betting strategy is volume. The more bets you place every day, the more insulated you are from variance. If you don’t believe me, check out our results. If you’re wondering how you can achieve the volume necessary to be a profitable +EV bettor, our sports betting tools are here to help. Let’s dive into how to use Portfolio EV’s +EV betting tools and model to help you build your bankroll. Make sure to check out our sports betting tools or our sports betting promos as well!

+EV Betting Tools: How to Use Portfolio EV

How Does Portfolio EV’s Model Work?

Before we talk about how to use Portfolio EV’s +EV betting tools, let’s talk about how they work. Portfolio EV indexes the odds from across the sports betting market, adjusts for hold, book sharpness and other factors, then generates a breakeven price called “true odds” against which all publicly available odds are compared.

When a wager is trading for longer odds than the true odds, we know that a bet is a +EV bet. How do we know this? Our model is carefully backtested to ensure we have a positive return on investment. Again, you can check out our results — or the results of our subscribers, some of which are included in this article.

While you can arrive at a +EV bet by other means, Portfolio EV’s market-based approach is a great way to build your bankroll. It relies on the presupposition that some sportsbooks are sharper than others, especially Pinnacle, a high-limit, low-hold offshore book.

Because Pinnacle has higher limits and lower hold than domestic books, also called public books, they have more incentive to post more efficient odds. We can use their lines to beat public books, who often price up overs (and price down unders) in hopes of pocketing more money from public bettors.

How to Use Portfolio EV

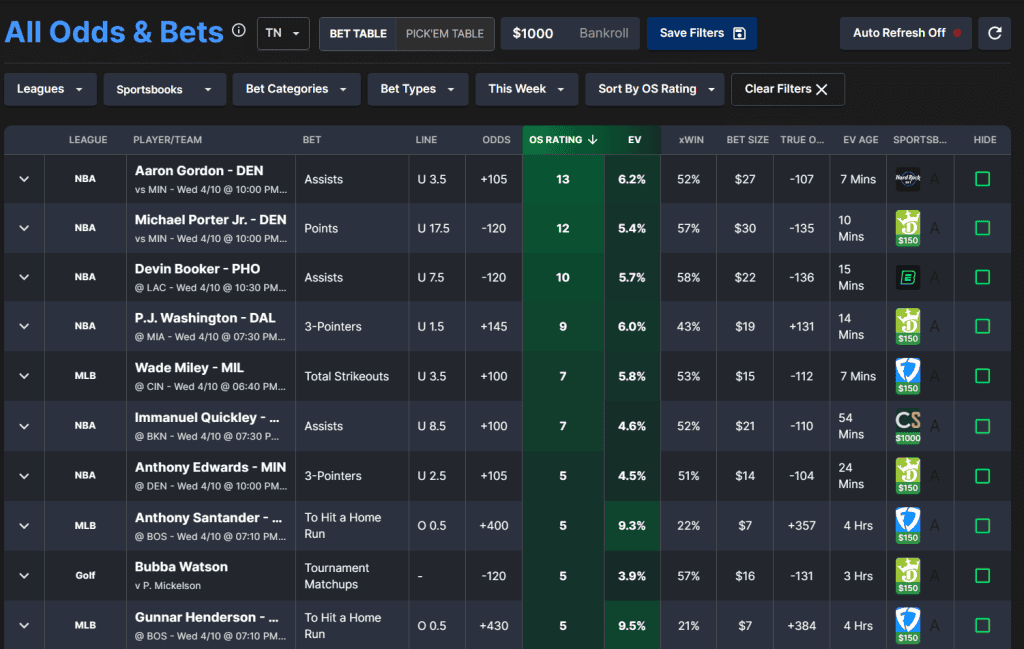

Now let’s talk about how to use Portfolio EV’s sports betting model. When you first sign up, you should navigate to the shop pages to see the best +EV bets today. It should look something like this:

You’ll find bets from a variety of sports and on a variety of markets. In this screenshot alone, we’ve got several NBA player prop bets, a few MLB player prop and home run bets, as well as a golf tournament matchup.

Our shop pages are customizable. You can change your state, which will lead to only wagers available to you rendering as +EV bets. You can customize your bankroll, which will change the recommended bet sizing. You can also filter by league, sportsbook, type of bet and when the game, match or tournament in question will occur

Next, let’s take a quick look at an example wager and how our product team describes each of the key terms.

Bet Size: The recommended bet size as a percentage of your bankroll. This metric is based on a fractional Kelly Criterion approach that leads to a reasonable balance of minimizing risk of ruin while maximizing potential reward.

EV: An abbreviation for “expected value,” this metric estimates the long-term profitability of a wager by taking into account the probabilities/payouts associated with each potential outcome.

xWin: The probability of winning the bet implied by the Sharp Sportsbook Algorithm true odds.

OS Rating: The OS rating provides a rating for each +EV bet. An OS rating above 20 signifies an exceptional bet. Ratings between 10 and 20 are highly favorable bets. Finally, a rating between 0 and 10 indicates a solid bet. We factor in the EV, expected win, bet size, and negative geometric drag to calculate this rating.

Hold: The synthetic hold across the entire market, which is the loss a bettor would sustain if he bet both sides of the market to win equal amounts. The larger the hold, the more difficult it is to beat that market.

Portfolio EV Sports Betting Tools & Tips

New to sports betting? OddsShopper’s selection of Betting 101 articles is here to help. We even have a parlay builder and our guide to parlay betting. Check out our guide to finding positive expected value (+EV), and you can unlock more +EV plays by signing up for Portfolio EV!