Sports betting can be incredibly fun. However, it’s a good way to lose money if you aren’t careful. As a sports bettor, you will deal with variance on a day-to-day basis — just like a stockbroker or a professional athlete. As such, it’s important to not overcommit your bankroll to any one wager, just like it’s important to not undercommit when you see a high-value wager. So how should you manage your sports betting bankroll? Portfolio EV is built to do some of the work for you. Make sure to check out our guide to the Kelly Criterion, the mathematical foundation for key parts of Portfolio EV, as well. But aside from those tools, let’s dive right into our expert sports betting bankroll management tips.

How to Manage Your Sports Betting Bankroll: 3 Expert Tips

Tip #1: Have a System & Trust It | Betting Bankroll Management Tips

This tip may come across as obvious, but it may surprise you how many sports bettors do not have a coherent process — or at least a coherent process that they actually follow. Of course, you know that it’s unwise to bet $20 on one wager and $40 on another at random, but the financial realities of the amount of money you have at a given book, the promotion that book is offering or even the proximity to your payday can easily sway you when it’s time to get your action down. My advice? Don’t let them.

Let’s talk about two different systems you can use when bet sizing. First, we’ll go over the Kelly Criterion, which is what Portfolio EV employs. Second, we’ll talk about the concept of “units,” which you may have heard about on X, formerly Twitter, or seen (or heard!) our content creators use when discussing their wagers.

How to Use Portfolio EV & the Kelly Criterion

Most sports bettors come into the game thinking that they’ll beat the books because they know more about sports than the operators do. That may be true, but it doesn’t guarantee a profit. Further, it doesn’t need to be true for you to be a profitable bettor. There are two main methods for profitable sports betting, projections-based approaches or market-based approaches, and the latter one doesn’t force you to know anything other than how sportsbooks operate. Both approaches simply use different sets of information to generate the odds of a given bet winning to identify wagers with positive expected value, or +EV.

Projection-based models are easiest for new bettors to understand. They’re not much different from those used by fantasy sports websites to estimate how well your team will perform on a given week. However, market-based models can be harder for bettors to understand. They rely on the assumption that some odds (and some action bet on those odds) are sharper than others. For example, if Pinnacle, which is widely considered a sharp book due to its userbase, has a bet priced at -150, but DraftKings Sportsbook, which is considered a public book, lists the same bet at +150 — it’s usually smart to take that bet.

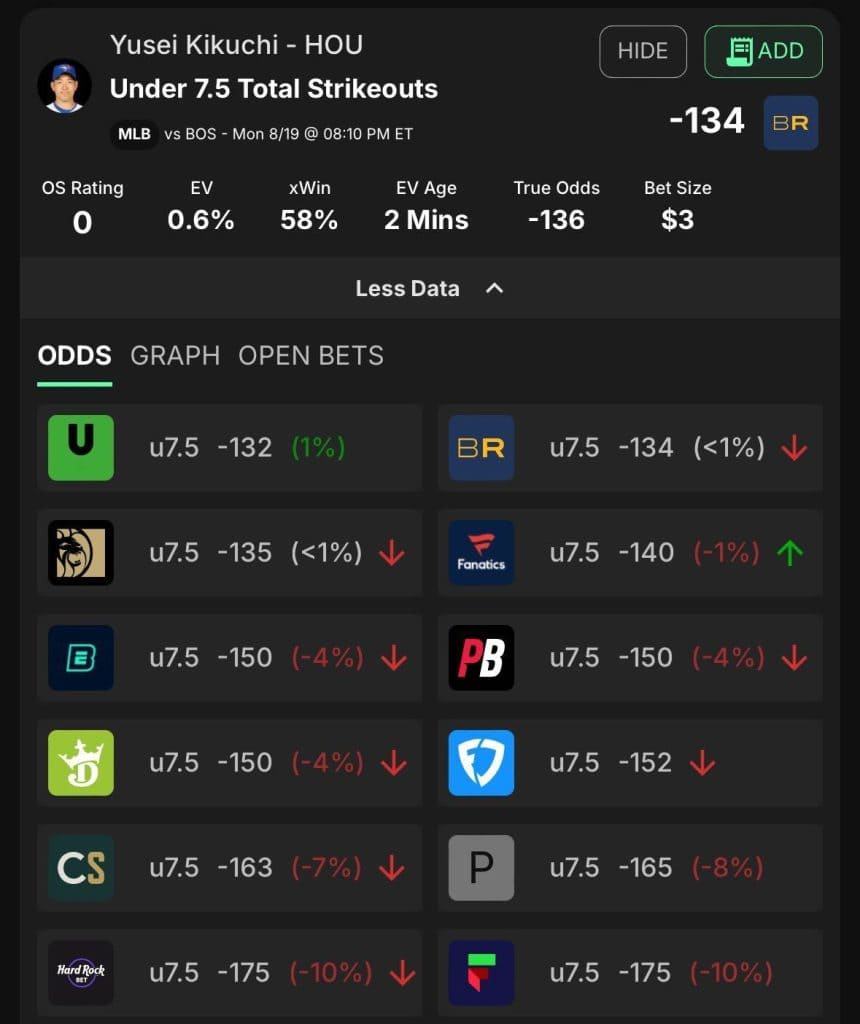

But knowing which books are sharper than the others — and determining how much edge the disparity in odds yields you — is more difficult. That’s why Portfolio EV is so useful: not only does it index each book by sharpness to generate true odds, or an estimate of each line without hold, but it also gives you an estimated bet size for each wager based on your bankroll, a number you can toggle to fit your needs via our software. Let’s dive into an example wager to break down how our product team explains it:

Bet Size: The recommended bet size as a percentage of your bankroll. This metric is based on a fractional Kelly Criterion approach that leads to a reasonable balance of minimizing risk of ruin while maximizing potential reward.

EV: An abbreviation for “expected value,” this metric estimates the long-term profitability of a wager by taking into account the probabilities/payouts associated with each potential outcome.

xWin: The probability of winning the bet implied by the Sharp Sportsbook Algorithm true odds.

OS Rating: The OS rating provides a rating for each +EV bet. An OS rating above 20 signifies an exceptional bet. Ratings between 10 and 20 are highly favorable bets. Finally, a rating between 0 and 10 indicates a solid bet. We factor in the EV, expected win, bet size, and negative geometric drag to calculate this rating.

Hold: The synthetic hold across the entire market, which is the loss a bettor would sustain if he bet both sides of the market to win equal amounts. The larger the hold, the more difficult it is to beat that market. While uncommon, a negative synthetic hold is possible. Negative synthetic holds are arbitrage situations (also known as arbs) where a bettor can guarantee a profit by booking both sides.

True Odds: Odds that represent the real statistical probability of any outcome in a particular sporting event.

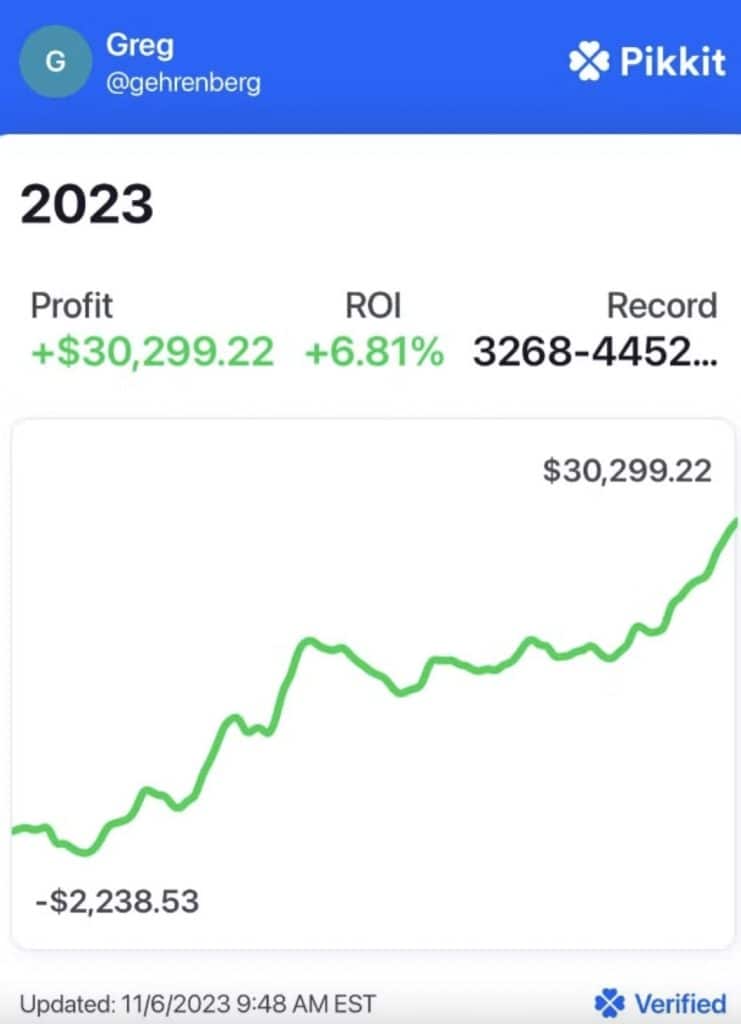

Check out Greg Ehrenberg’s profits from Portfolio EV!

How to Use Units

Many of OddsShopper’s experts will write about bets in terms of something called “units.” A unit is a percentage of your bankroll, which is usually 1%, but, if your risk tolerance is higher, can be up to 5% or so. The logic behind units is the same as the logic behind the Kelly Criterion: you can’t win 100% of your bets, so it’s necessary to protect yourself from variance by not overexposing yourself to certain wagers.

Just as with Kelly Criterion-based bet sizing, you can adjust the number of units you feel appropriate to wager on a given bet by adjusting your estimated win probability. If you think a given bet hits, say, 60% of the time, and you’re buying it at odds of 50%, it might make sense to take advantage of that 10% edge by placing a multi-unit wager. Conversely, if you estimate its win probability at just 52% — but you also want exposure to the match or game in question — wagering less than a full unit would be smart.

When OddsShopper’s experts discuss bet sizing in terms of units, it’s because they’re conducting a process similar to what the Kelly Criterion is doing, albeit in different terms and often through a less mathematical process. You don’t need to commit to either Kelly bet sizing or unit-based bet sizing, but if you don’t, you must come up with some hybridized or other process for sizing your bets — and whatever you do, don’t fall victim to the trap of Martingale betting systems.

Tip #2. Remove Biases from the Equation | Betting Bankroll Management Tips

As a sports bettor, losing sucks. There are few things less enjoyable about sports betting than losing money, especially in dumb situations late in the game, like losing an under on a last-second, meaningless touchdown (I’ve suffered this fate twice this season on LSU football games alone. Just take a knee!). But when you let losses — especially unlucky losses — cloud your judgment, you’re likelier to end up with an empty bank account than a rebuilt bankroll.

Discipline is incredibly important in sports betting, as is a basic knowledge of logical fallacies. One common trap that sports bettors fall into, appropriately called the “gambler’s fallacy,” occurs when you think the outcome of a certain random event is made more or less likely by the occurrence or non-occurrence of another random event. Said another way, if you lose big on one bet but bet even bigger on the next one because “you’re due,” — or if you wager all your winnings from one bet on another because “you’re hot,” — you’re committing the gambler’s fallacy. Don’t chase your losses or your wins.

Plenty of other logical fallacies can sink your bankroll faster than you can rebuild it. Anchoring bias, or the tendency to place too much stock into one piece of information (often the first piece of information acquired), can often be a problem. If you fade one team at the start of the year because you heard a sharp say that team’s quarterback stinks — only for that quarterback to have a big game in the opener — it’s not always wise to stay anchored to your priors and fade that team again the next week.

Tip #3. Track Your Results | Betting Bankroll Management Tips

Do you know how much money you’ve made betting on sports in the last year — or what your return on investment is through that span? If so, great! If not, that’s a problem. I can answer both of those questions by flipping to my tracking spreadsheet and updating it for my balance at each book. Some sites exist to do the heavy lifting for you, but I prefer to do that on my own. Personally, having to manually log each wager and update the sheet after each win and loss keeps me accountable: I can always tell you exactly what my balance is, which means I always know how much I can afford to lose.

I know plenty of casual bettors who throw longshot parlays and have to deposit more into their accounts every month when they inevitably run out of money. While betting on longshot parlays can be a viable strategy, if you aren’t deliberate about bet sizing, your hobby will quickly become an expense — and one you may not fully appreciate. Let me make two analogies.

For casual bettors: if you don’t want to pay the $174.99 a year for NFL Sunday Ticket through YouTubeTV because it’s too expensive, why would you pay $350 to the sportsbooks for the right to place losing bets? The one-time charge of $174.99 may be more obvious than the monthly $80-to-$90 drain on your bank account (and bankroll) that inefficient sports betting would cause in this hypothetical, but it wouldn’t be cheaper.

For bettors looking to make a profit: if you’re picking between high-yield savings accounts, you’ll probably want the one that returns the highest interest rate, right? That’s how you should think about your sports betting bankroll. If you can secure a higher return on your investment by locking your money away in an FDIC-insured account than by betting on sports, why not put most of your money there, instead of in your bankroll? It’s difficult to make a rational choice when you don’t know your own ROI from sports betting. Definite the limits of your bankroll based on the returns you know you can secure.