The phrase “positive expected value,” also called “+EV” for short, gets bandied about a lot in the sports betting space. If you’ve been betting frequently and consuming serious content (i.e. OddsShopper’s videos and articles), I’m sure you’ve come across the term. You might have a general sense of what +EV actually means. Nevertheless, if you have any questions about what positive expected value is or how to identify positive expected value, we at OddsShopper are here to help you understand — and help you find winning +EV bets!

Expand your bankroll and boost long-term profitability with Portfolio EV. Discover more +EV bets with a FREE TRIAL. Visit our Portfolio Betting page today!

In Summary

- +EV (Positive Expected Value) means your bet has a higher probability of winning than the odds imply — it’s the foundation of smart, long-term profitable sports betting.

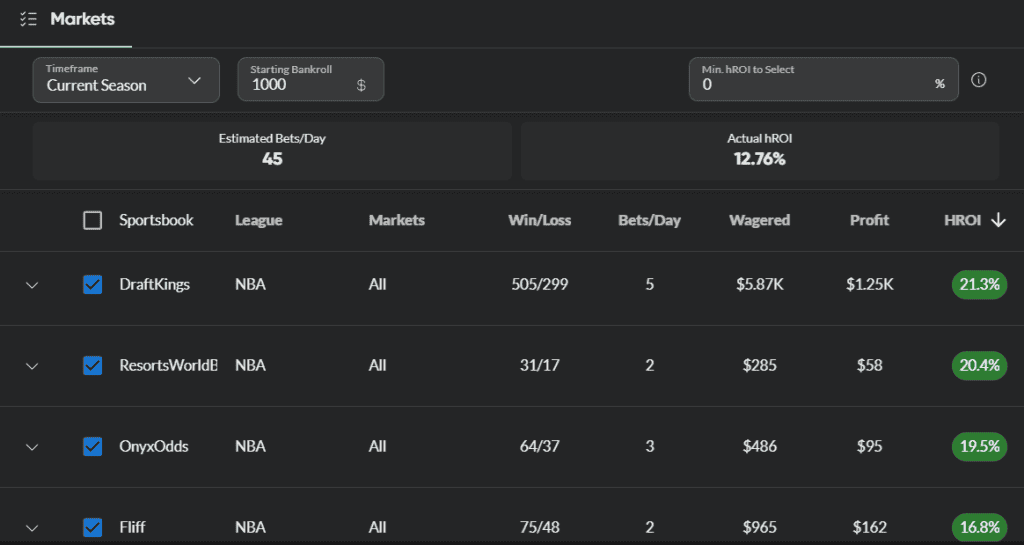

- You don’t need to predict outcomes, just identify mispriced lines in the market using tools like Portfolio EV, which compares sharp books vs. public books to surface +EV bets automatically.

- Portfolio EV helps you spot value, size bets using a modified Kelly Criterion, and evaluate bets based on OS Rating, expected win rate (xWin), and market hold.

- Expected value in sports is always theoretical — unlike poker or card games, sports outcomes are uncertain and driven by assumptions, so discipline and risk management are key.

- Bankroll strategy matters: Use conservative or fractional Kelly staking to balance profit and risk, especially when your confidence in the edge is low.

- Line shopping is critical: Even a few cents difference in odds can dramatically impact your long-term profitability and reduce exposure to negative variance.

- Portfolio EV users are winning: Real bettors share their results — consistent +EV betting using the tool has led to steady bankroll growth across sports markets.

What is +EV? Positive Expected Value Explained

In short, for a bet to be considered a positive EV bet, the probability of cashing on the bet is higher than the odds implied by the price of that bet. Conversely, if your wager’s shot at hitting is less than what you need to break even, then it’s a -EV play.

Let’s say you want to bet on the Bears to cover as 3.5-point home underdogs versus the Packers. The book is offering dime lines of Bears +3.5 (-110) and Packers -3.5 (-110). Without getting into details of how the Vig is handled, just know that it means that sportsbooks are holding approximately 2.4% of the wagers on markets priced at -110/-110.

So in the case of the Bears +3.5, you will need that bet to hit more than 52.4% of the time to have an edge. With 52.4% set as a breakeven point, if you think the Bears will cover more than 52.4% of the time, then the bet is +EV.

Check out the video below. Loughy demonstrates how to use Portfolio EV and how we focus on finding inefficiencies in the market rather than trying to predict the outcome of individual games — this is how he and other OddsShopper members keep winning!

Ready to increase your bankroll by finding the best +EV bets? OddsShopper’s Portfolio EV is your answer.

How to Identify +EV Bets

So how do you identify +EV bets? Firstly, you need some method for identifying the probability that a given wager will win. There are two main methods for calculating this probability: projections-based modeling or market-based modeling. You’re probably familiar with projections-based modeling if you’ve ever seen ESPN’s win probability estimates or fantasy football projections, but market-based modeling is a bit trickier to understand.

Instead of calculating the probability of an outcome based on on-the-field data, market-based models assume that some odds — and some bets wagered on those odds — are sharper than others. Take Pinnacle, for example. Pinnacle is a high-limit, offshore sportsbook. If the house makes a mistake there, it stands to lose more money than a public book.

If Pinnacle lists a bet for -150 but FanDuel Sportsbook, which is considered a public book, lists the same bet at +150, you probably want to have action on that line. However, understanding which books are sharper than others (and knowing at what point your edge overcomes the hold that each book is taking out) can be difficult. Fortunately, That’s why Portfolio EV does the hard work for you. Let’s take a quick look at an example wager and how our product team describes each of the key terms.

Bet Size: The recommended bet size as a percentage of your bankroll. This metric is based on a fractional Kelly Criterion approach that leads to a reasonable balance of minimizing risk of ruin while maximizing potential reward.

EV: An abbreviation for “expected value,” this metric estimates the long-term profitability of a wager by taking into account the probabilities/payouts associated with each potential outcome.

xWin: The probability of winning the bet implied by the Sharp Sportsbook Algorithm true odds.

OS Rating: The OS rating provides a rating for each +EV bet. An OS rating above 20 signifies an exceptional bet. Ratings between 10 and 20 are highly favorable bets. Finally, a rating between 0 and 10 indicates a solid bet. We factor in the EV, expected win, bet size, and negative geometric drag to calculate this rating.

Hold: The synthetic hold across the entire market, which is the loss a bettor would sustain if he bet both sides of the market to win equal amounts. The larger the hold, the more difficult it is to beat that market. While uncommon, a negative synthetic hold is possible. Negative synthetic holds are arbitrage situations (also known as arbs) where a bettor can guarantee a profit by booking both sides.

For some real-life examples, we have a number of folks who are tracking their results with Portfolio EV; see the latest from them below:

Expected Value is Theoretical | +EV Sports Betting

You’ve probably already realized that figuring out your “edge,” or the percent chance of your bet hitting, is the critical component to +EV betting. But how do you know the true chance of a bet coming through before a game has been played? The reality is that, in sports betting, you never will know anything for certain.

The concept of EV got its start in formal statistics and investing and was later exported to card games like poker. All of these mediums are quite different from sports gambling. That is especially true for card games. Consider the percent chance of something happening in a poker game that uses a 52-card deck. Unlike investing or sports, the “world” of cards is bracketed to those 52 possibilities, including their various numbers and suits. The key is that the number of possibilities is set and never changes. Precise probabilities can be calculated, as can a precise Expected Value because you can specifically gather the likelihood of pulling something out of the deck.

Sports are completely uncertain. We can get an idea for how often something happens by building models that take a possible range of outcomes and compare them to the average or mean outcomes. You can try playing out scenarios or different variations or variables on a sports game and seeing how they would affect the model (known as a regression), but those are always assumptions. We can only input our own assumptions about sports, teams and players before the actual sporting event. In the end, reality happens and the game is played with all the uncertainties that humans bring and cards do not.

That is why you must think of EV as something theoretical. It is an estimate of your percentage chances based on assumptions, whether you are using quantified models or your own “take” on a game or player prop.

Portfolio EV is back-tested to ensure that they come as close to real game outcomes over a large sample size. Nevertheless, they are models that estimate probabilities and do not compute finite scenarios like a deck of cards.

The +EV opportunities you’ll have in gambling are going to come when the model is slightly off from Vegas. That is where you spot opportunities in a line. But it raises a question of, how off is the model? And how precise is it on any given bet? It’s impossible to answer.

You will never know exactly what your percent chance of winning a bet is because sports do not have set parameters like a card game. Your best bet is to have a theoretical +EV.

This concept of EV, in theory, has important implications for how you size your bet and the volume of bets you place. Both will depend on how confident you are in your perceived edge. First, let’s look at some ways to think of betting sizing in relation to expected value.

Uniform Bet Sizing vs. Kelly Criterion Betting | +EV Sports Betting

One way to mitigate the uncertainty in your chances of winning is to control your bet sizing. Uniform bet sizing is a straightforward way to do this despite some flaws. If you bet the same amount on every bet, then you won’t have to worry about over-betting your bankroll when your theoretical win probability is lower than you thought. The downside to that approach is you will also be over-betting your roll in the times that your win chances are lower than you thought they were.

The other issue is that you will be missing out on opportunities to grow your bankroll when you spot large +EV situations. If you notice a bet that has a huge expected ROI, you might want to “hammer” it by betting more, even if that ROI is only theoretical.

There’s a method that accounts for this called the Kelly Criterion. We’ll cover it more in-depth in future articles and get into the weeds of its history and mathematics. For our purposes here, what’s important is that the method helps you adjust your bet size depending on the percentage EV that you have. Likewise, you can size your Kelly bets to the full equation or some fraction of it depending on your confidence in a single bet or the entire projection source. Kelly Criterion betting allows you to make the most of EV and to lower your risk a bit in scenarios where the edge is present but smaller.

Before moving on, there are a few other considerations you have to consider when varying your bank size based on theoretical EV or plain confidence. For one, if you are frequently betting into small theoretical edges, you are likely to increase your variance. A 10% edge is going to come through for you 10x more than a 1% edge. Not all value is created equal, so if you are unable to sustain larger swings in your bankroll, you may want to avoid some bets, even if they are technically +EV. When you do make 1% bets, your expected ROI is going to be lower, so in the case that you are playing even small edges like those, you will also need significant betting volume to steadily grow your bankroll.

When you do spot a large, highly +EV bet, even if a Kelly Criterion calculator suggests betting a large portion of your bankroll (at a fraction of Kelly, even), you still must consider your own personal risk tolerance. You may even want to question the robustness of your projections or personal “take” on the bet. Making huge bets can be tough for your bankroll and tough for your “life EV” if they put you at risk. So being completely stuck to the process and its suggestions for +EV betting can be something to avoid to stay within your comfort zone.

These are just some of the finer points of bet sizing as they relate to expected value.

Line Shopping Still Key | +EV Sports Betting

Considering how fragile EV is, and how you can never be completely certain how robust your prediction is, you can start to see another reason why line shopping is so important. Given that your real edge varies a small amount from your estimated EV, then a few cents on every bet is crucial.

If you think your win probability for a bet is 55% and it’s a -110 line, then you’ll have $5.00 of EV for every $100 you bet. However, what if your theoretical edge, in reality, was 54%? That would take your EV down to approximately $3. And the more your theoretical win chances are off from your estimate, the more risk you run of going in the red. But if you happen to shop for the best lines (using Portfolio EV’s positive EV betting tools, of course), you may find the best at a -105 Vig. In that case, your EV would be around $5, even if you overestimated your win probability.

Margins are slim in sports betting, but getting the best lines available will add up over time. They’ll also give you some cushion on your EV and mitigate losses when you might unknowingly be placing -EV wagers. Shopping, bet sizing and understanding the nuances of EV itself are just three concepts to think about whether you are beginning as a sports bettor or fine-tuning your process.