In the world of NFL betting, understanding how to approach the market is crucial for long-term success — but there is no one universally agreed-upon way to do it. Generally speaking, there are two primary strategies for analyzing and betting on games: The Top-Down (market-based) and Bottom-Up (projection-based) approaches. These methods offer different perspectives on how to find value in the betting markets, but which one should you use? And which method do we at OddsShopper use for Portfolio EV?

Top-Down vs. Bottom-Up NFL Betting: +EV Betting Strategy

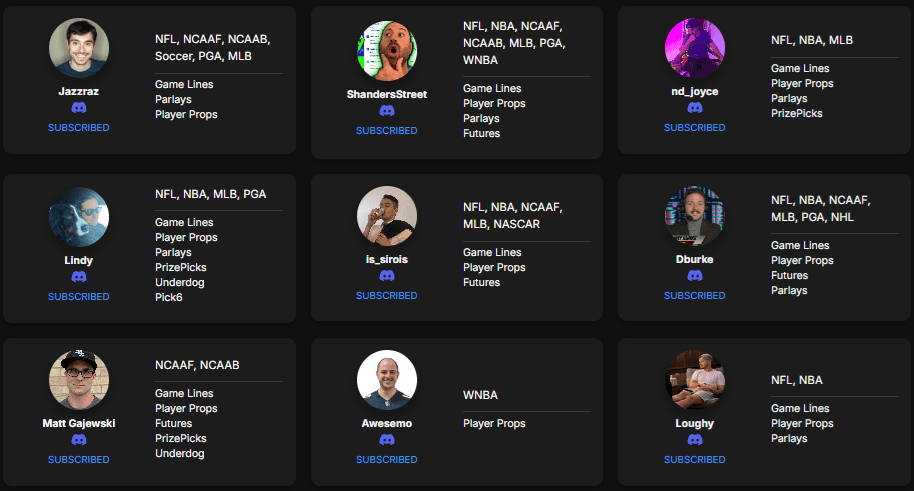

Want to spot sharp opportunities as soon as they appear? Check out Tails By OddsShopper! These are real sharp bettors who want nothing more than to win their bets and help you win yours — check out our list of OddsShopper Tails:

The Top-Down Approach

The Top-Down approach involves starting with a broad analysis of the betting market itself rather than focusing on individual games. This method is about identifying inefficiencies in the market by comparing different sportsbooks, looking for discrepancies in odds, and understanding where the public and bookmakers might be making mistakes.

Key Principles of Market-Based Approach

Market Analysis: The first step is to assess the overall market. This involves comparing lines across multiple sportsbooks to find differences. Since each sportsbook sets its lines independently, you can often find value by shopping around for the best sports betting odds.

Identifying Market Inefficiency: By analyzing where lines differ between sportsbooks, you can identify opportunities where the market might be inefficient. Now, that is not to say that every time one or a few sportsbooks differ from the majority that those outliers present value. They may actually be the only book or books that are setting lines correctly.

That is where identifying “true odds” becomes extremely important. If the odds associated with the different line are more favorable for the bettor than the true odds (or where the market says the odds should be), that is where you find a market inefficiency of which you should take advantage.

Leverage Public Perception: A market-based approach also takes into account how public perception affects betting lines. The public often overreacts to recent events (like a team’s big win or loss), which can create value if the market over-adjusts the line.

The Bottom-Up Approach

The Bottom-Up approach, on the other hand, focuses on making your own assessment of individual games, evaluating what you think the line should be and then comparing it to the betting lines offered by sportsbooks. This method can involve a detailed breakdown of team matchups, player performances, injuries and other factors that might influence the outcome of a game, and/or it may include building your own projection system.

Key Principles of a Projection-Based Approach

Game-Specific Analysis: Bottom-Up betting begins analyzing the specific game you’re interested in. Consider factors like team statistics, head-to-head matchups, injuries, weather conditions and coaching strategies. This granular analysis helps you form an opinion on how the game will play out.

Creating Your Own Line: Based on your analysis, create your own point spread or total for the game. Compare your line to the one offered by the sportsbook. If your line differs significantly from the market’s, you might have found a betting opportunity.

Exploit Specific Matchups: A projection-based approach also focuses on identifying mismatches that might not be fully reflected in the betting line, like a great passing offense against a team that does not get a lot of pressure on the quarterback.

How Portfolio EV Can Help

The philosophies behind Portfolio EV are largely Top-Down because we employ a market-based strategy. Positive expected value (+EV) is best found by analyzing the industry and market inefficiency; profitability is much more maintainable when you view sports betting from a macro, long-term sense, and market inefficiency by definition is a crack where sportsbooks are benefiting the sports bettor. That said, there are some facets of Portfolio EV that may appear to be Bottom-Up.

Here are the various aspects of Portfolio EV and how they fit into these boxes.

Odds Comparison: OddsShopper allows you to compare odds across multiple sportsbooks, making it easier to spot market inefficiency— a key component of the Top-Down approach. If you find that one sportsbook is offering better odds than the others, you can quickly act on that opportunity.

Expected Value Calculations: The way OddsShopper calculates breakeven points of profitability is via “true odds.”

This is what we calculate the odds should be based on the bet’s likelihood of winning, and we build out our EV estimations around the discrepancy between those true odds and sportsbook odds. Again, calculating EV (and OS Rating) is more a facet of a Top-Down approach because we are looking at edge compared to other sportsbooks and market inefficiency. It may appear to be more of a Bottom-Up style because we are establishing what the odds should be — and on an individual game sense there is some merit to this — but the theory behind the true odds and EV calculations is Top-Down.

Conclusion

The Top-Down and Bottom-Up approaches offer two different but potentially complementary strategies for NFL betting. By mastering both methods, you can gain a comprehensive understanding of the betting market and find value in different ways. Ultimately, the key to success in NFL betting lies in understanding where the market is inefficient and exploiting those opportunities, and Portfolio EV can enhance your strategy and help you make more informed, profitable bets.