It’s common to hear sports bettors ask “what does Vegas think?” about a game, or to lament that “Vegas always knows” when their bet loses. You might hear these sayings a lot — even from veteran sports gamblers — but they can be misleading. What Vegas knows and does not know is a projection of the betting market. Sportsbooks make odds by following the wisdom of the crowd.

That might seem counteractive. Those common sayings capture the general public’s understanding of sportsbooks, which is that they set the lines based on how they see a game or prop playing out. That’s true to some extent. A “market maker” book sets an opening line that other books may follow. Once the initial odds are set, other sportsbooks match those lines and early action comes in across the market.

As bets come in on the opening line, it initiates the process of price discovery. Sportsbooks assume that bettors, especially the sharpest ones, have enough wisdom to make positive expected value (EV) wagers. Early action from those bettors is used to adjust the number. Books may follow the market maker as the odds adjust, or use the action they are receiving and their own liability tolerance to move the price themselves.

Odds prices ebb and flow throughout the lifespan of a betting market, eventually reaching the efficient price. That is why “closing line value” can be an indicator of long-term success in sports betting. If you made a bet on a football team to cover -2 points early in the week and it closed at -4, you found a lot of value from the most efficient price at the end.

Tapping Into the Wisdom of the Crowd

The basis for this odds setting method is to trust the wisdom of the crowd. Essentially, sportsbooks know that they don’t know everything. The more minds that can bet into a market, the more likely they are to arrive at the correct odds sooner.

It may come as a surprise, but the concept of the “wisdom of the crowd” indicating the sharpest price in a given market once won a Nobel Prize. The economist Eugene Fama made this the basis of the “efficient market hypothesis,” a theory that states that the most accurate price of a commodity — in his case, financial securities — is arrived at through the coalescence of all publicly available information. In other words, the price of a stock reflects the information available to anyone in the market purchasing that stock.

Fama also proposed that private information could be embedded within prices. In that case, stocks could reflect specialty knowledge that some people had and others did not. Back to sports betting, that is analogous to the sharp bettors who books rely on most to set their prices. When the opening line comes out, a book won’t just look to any action, but usually the sharpest action in order to determine where (or if) they should move the number. This is particularly salient at the sharpest “market making” books.

Sportsbooks’ reliance on the wisdom of the crowd to set odds is crucial to understand for any serious sports bettor. However, it’s important to not read too into the line moving one way or another, even early in the week. Market-making books do have their own opinion on a side or total, and they may be trying to get more action booked one way or the other. Moves can reflect their willingness to take on liability by being exposed to their preferred side.

Early action is also not necessarily the sharpest action, even if it comes from some of the sharpest bettors. Professional gamblers are always engaged in a cat-and-mouse game with books. Knowing that the lines might move as a result of their bets, sharp bettors or gambling “syndicates” have been known to make wagers to throw off the efficient price. Many sportsbooks have a response as well, often limiting early action to a much lower limit, say $2,000, compared to what they will take on a side or total right before a game.

While you don’t need to know every detail of how sportsbooks set odds, you should get a solid understanding of the process. Recognizing what’s going into a price at the outset of a sports betting market and as the market matures is an important skill for any market-based bettor.

Inefficient Betting Markets

If efficient odds-making relies on the wisdom of the crowd and all available information, then inefficient odds are those where the crowd has erred in its judgement. It’s rare to find market inefficiencies in large markets because there is so much information and so many eyeballs on the statistical data and news. That’s why most people talk about the NFL as being the most efficient market in sports betting. Major sports like soccer, the NBA, MLB and tennis aren’t far behind.

The evaluation of market efficiency in those sports usually refers to spreads, totals and moneylines. Prop markets are notoriously inefficient. Sportsbooks offer such a wide array of props in major sporting events that it becomes difficult to effectively price them and to keep up with changes in news, weather or other factors that impact the game. It’s difficult to monitor and then quickly integrate player level information with changing game conditions.

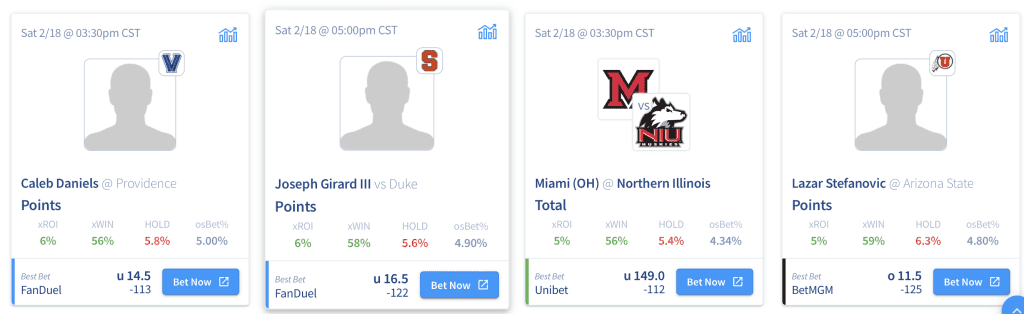

The OddsShopper Shop Bets page finds those inefficiencies for you.

In addition to props, sports with less information and smaller betting markets have less efficient odds. On the spectrum of efficiency, things like table tennis or arm wrestling are strong bets to be mispriced because there simply isn’t much of a “crowd” to derive wisdom from.

That doesn’t mean you should go betting into these, but it does mean that there’s room to take advantage if you put in the work. Sportsbooks are well aware of their blind spots, so low info or immature markets are often juiced heavily to account for the lack of knowledge. The lesson is to spot places where information may be weak or poorly evaluated by the betting public. When you spot those inefficiencies, whether in traditional lines, props or niche sports, you can gain a leg up.

There is a lot of nuance to how sportsbook set odds. This summary only cracks the surface of how the wisdom of the crowd affects betting prices but provides inroads for honing your skills at market-based sports betting. There’s also the key factor of bankroll management. With experience and time, you’ll become much more attuned to the behavior of odds prices and be able to use this to your advantage.

Of course, our tools make all of this even easier. Find out more here.